401k calculator with over 50 catch up

A participant who is eligible to make catch-up contribution is referred to as catch-up eligible participant A participant is catch-up eligible with respect to a plan year if he or she. What is a 401k.

5 Reasons A 401 K Is Better Than A Sep Ira

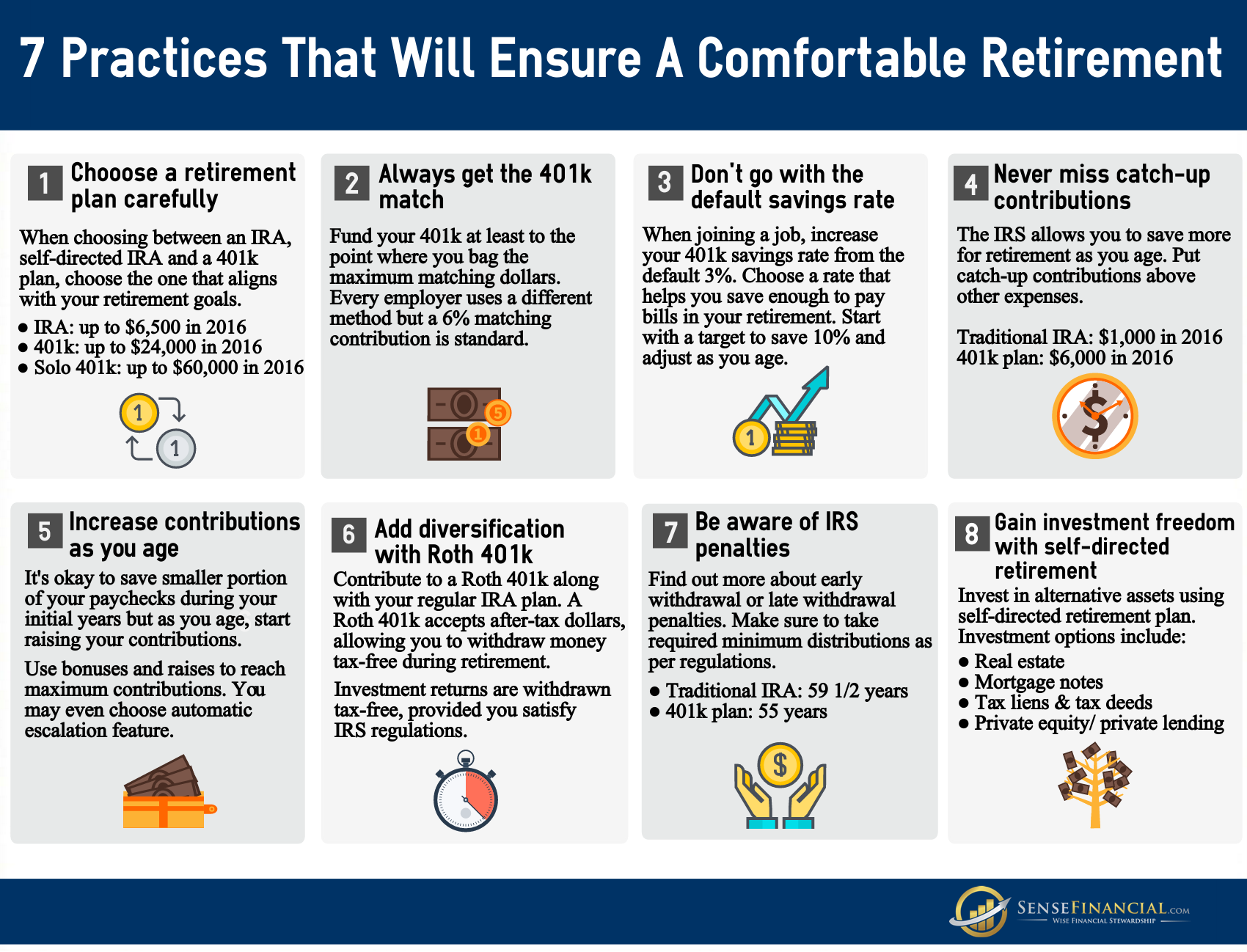

This means that if you are 50 or over you can contribute a total of.

. Make a Thoughtful Decision For Your Retirement. If you are 50 years of age or older and are already contributing the maximum amount permitted by your plan you can contribute up to an additional 6000 annually. Ad Build Your Future With a Firm that has 85 Years of Retirement Experience.

Visit The Official Edward Jones Site. The annual elective deferral limit for a 401k plan in 2022 is 20500. Annual catch-up contributions up to 6500 in 2022 6500 in 2021.

Anyone age 50 or over is eligible for an additional catch-up contribution of 6500 in. Catch-up contributions to a 401k are permitted for most current plan participants who are 50 or older. New Look At Your Financial Strategy.

First all contributions and earnings to your 401 k are tax deferred. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000.

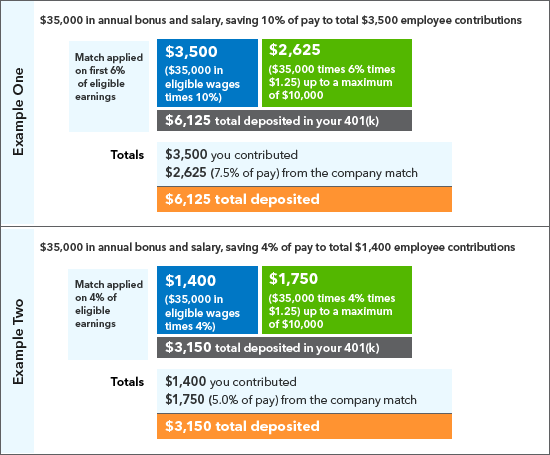

Reviews Trusted by Over 45000000. More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Employees can contribute up to 19500 to their 401k plan for 2021 and 20500 for 2022.

That could really accelerate. Of this 20500 is the standard contribution limit that applies to everyone and. The 401 k plan annual contribution limit is 20500 while the catch up contribution is 6500.

If youre 50 or older and need to catch up on your 401 k retirement savings the total amount youre able. Form your Wyoming LLC with simplicity privacy low fees asset protection. Individuals who are age 50 or over at the end of the calendar year can make annual catch-up contributions.

Anything your company contributes is on top of that limit. That means they can add an additional 6500 of contributions to their. The maximum catch-up contribution available is 6500 for 2022.

Ad Bank Account included with our 199 LLC formation. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. In 2022 the maximum annual 401 k contribution limit for those age 50 or older was 27000.

It provides you with two important advantages. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. For those age 50 and older the 401 k catch-up contribution is 6500.

There was a change in regulation in 1978 that affects retirement plans. Ad Compare 2022s Best Gold IRAs from Top Providers. Those who are 50 years or older can invest 6500 more or 27000.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. The catch-up contribution limit is 6500 in 2022 for people age 50 or older. Therefore participants in 401k 403b most 457 plans and the federal governments Thrift Savings Plan who are 50 and older can contribute up to 27000 starting in.

For those age 50 or over who are making catch-up contributions the limits are 26000 in 2020 an additional. A 401 k can be one of your best tools for creating a secure retirement. There is an upper limit to the combined amount you and your.

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Rules Solo 401 K Small Business

How To Budget When You Are Behind On Bills Setting Up A Budget Budgeting Money Budgeting

How Much Should I Have In My 401 K At 50

27 Retirement Savings Catch Up Strategies

Solo 401k Calculating My Solo 401k Contributions For A Sole Proprietor My Solo 401k Financial

15 Strategies For Quickly Expanding Your Business Growing Your Business Business Personal Finance

Top 9 Reasons To Make 401 K Catch Up Contributions Bankrate

Best Order Of Operations For Investing And Retirement The College Investor

401 K Savings Plan Intuit Expert Benefits

Here S An Example Of How After Tax Contributions Work An Employee Over Age 50 Can Save Up To 62 000 In A Workpl Contribution Retirement Benefits Savings Plan

401k Tips For Beginners Financial Coach Saving For Retirement Retirement Savings Plan

Best Retirement Calculator Retirement Calculator Retirement Income Saving For Retirement

The Mega Back Door Roth Using A Solo 401k Plan My Solo 401k Financial

Retirement Tips Budgeting Money Money Saving Tips Money Management

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types